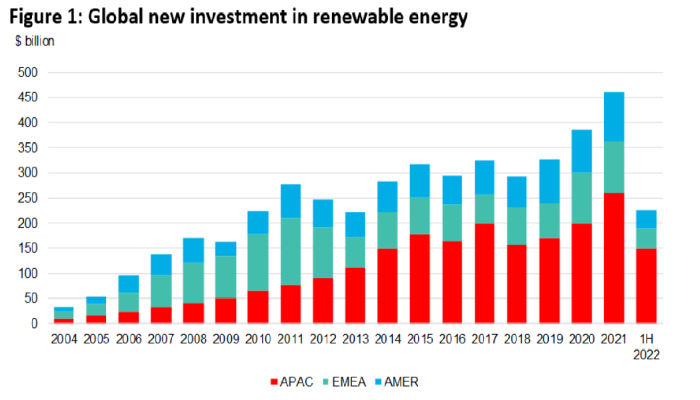

Worldwide renewable investment in 2022 reaches half-year record of US$ 226 billion, China blazing a trail

The Renewable Energy Investment Tracker 2H 2022 report, which covers both project investments and also company fundraising, disclosed that investment in new solar projects rose to a record-breaking US$ 120 billion in H1 2022, up 33% from H1 2021.

H1 additionally saw an all-time record for venture capital as well as private equity investments right into renewables and also energy storage, with US$ 9.6 billion increased, which was up 63% on the previous year.

One group that saw dropping investment, however, was public equity issuances. After a strong H1 2021, public market issuances for renewable energy business dropped 65% in H1 2022, representing US$ 10.5 billion. While the Q2 figure, at US$ 3.9 billion, is the lowest quarterly overall since Q2 2020.

As expected, China led the way and published significant investment growth in both wind as well as solar project finance, with the nation's large-scale solar investments amounting to US$ 41 billion in H1 2022, up 173% from the year before.

The U.S became the second-largest solar market investing US$ 7.5 billion, adhered to by Japan at US$ 3.9 billion.